In the ever-evolving landscape of cryptocurrencies, where digital gold rushes unfold daily, efficient mining machine hosting has emerged as a cornerstone for savvy investors and miners alike. Picture this: vast server farms humming with activity, churning out blocks of Bitcoin and Ethereum, all while you sip coffee from the comfort of your home. But what truly drives the allure of these operations? It’s the intricate price structures that make hosting a mining rig not just feasible, but profoundly profitable. From the blistering speeds of ASIC miners to the robust frameworks supporting altcoins like Dogecoin, understanding these costs can unlock doors to substantial returns.

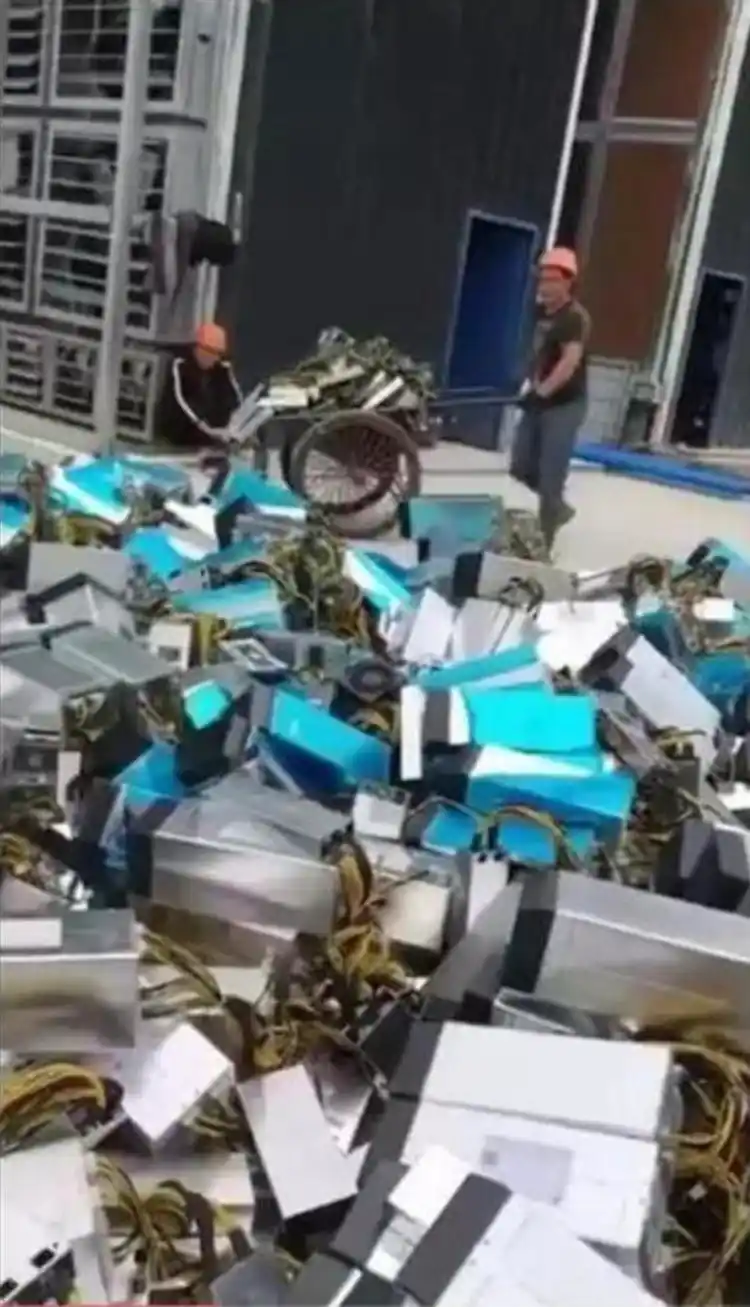

Delving deeper, mining machine hosting involves outsourcing your hardware to specialized facilities, often called mining farms, which provide the necessary infrastructure for optimal performance. Imagine rows upon rows of miners, their fans whirring like a symphony, powered by renewable energy sources in remote locations. This setup not only slashes operational costs—think electricity bills that could otherwise drain your wallet—but also enhances security against hacks and hardware failures. For enthusiasts dabbling in Ethereum’s proof-of-stake evolution or Bitcoin’s enduring proof-of-work, these hosts offer tiered pricing models that fluctuate based on factors like hashrate demands and contract durations, creating a dynamic marketplace that’s as unpredictable as the crypto markets themselves.

Now, let’s unpack the price structures that govern this realm. At its core, efficiency reigns supreme; a top-tier mining rig might command premium rates due to its energy consumption and output potential. For instance, hosting a Bitcoin miner could involve upfront fees for setup, ongoing costs for maintenance, and variable charges tied to network difficulty. Contrast this with Ethereum, where the shift to proof-of-stake has reduced the need for power-hungry rigs, potentially lowering hosting prices. Yet, for Dogecoin aficionados, the lighter network requirements mean even budget-friendly options can yield surprising profits, adding layers of complexity to your decision-making process. These structures aren’t static; they ebb and flow with global events, from energy crises to regulatory shifts, making each hosting agreement a calculated gamble.

Burst onto the scene are innovations in mining technology that promise to redefine efficiency. Advanced miners, equipped with cutting-edge chips, can process transactions for multiple currencies simultaneously, blending the worlds of BTC, ETH, and DOGE into a cohesive strategy. Hosting providers often sweeten the deal with bundled services, such as real-time monitoring dashboards and automated failover systems, ensuring your investment doesn’t falter amid volatility. But beware: the true cost isn’t always transparent. Hidden fees for cooling systems or data transfer can accumulate, turning a seemingly affordable setup into a financial quagmire. This is where diversity in offerings shines—some hosts specialize in eco-friendly operations, appealing to the environmentally conscious miner chasing both profits and sustainability.

As we navigate this intricate web, it’s essential to consider the broader ecosystem. Exchanges play a pivotal role, allowing miners to swiftly convert their harvested coins into fiat or other assets, influenced directly by hosting efficiency. For Bitcoin purists, the focus might be on maximizing hashrate to outpace competitors, while Ethereum enthusiasts prioritize scalability for decentralized applications. Even niche players like Dogecoin have carved out spaces, where community-driven hype can spike values overnight, underscoring the need for flexible hosting plans. Ultimately, the rhythm of these price structures dances to the beat of innovation, urging participants to stay agile and informed in this exhilarating pursuit of digital wealth.

In conclusion, embracing efficient mining machine hosting isn’t merely about crunching numbers; it’s about orchestrating a symphony of technology, strategy, and foresight. Whether you’re a novice with a single miner or a veteran overseeing a fleet in a sprawling mining farm, the key lies in deciphering these price dynamics to harness the full potential of cryptocurrencies. As the industry marches forward, with Bitcoin solidifying its dominance and newcomers like ETH and DOGE pushing boundaries, the world of hosting remains a vibrant, ever-shifting frontier ripe for exploration.

This article offers a comprehensive exploration of the nuanced landscape of mining machine hosting price structures. By dissecting various pricing models, it reveals how factors like location, power costs, and service quality influence overall expenses. Readers gain valuable insights into optimizing their investments in a rapidly evolving industry.